what are federal back taxes

These are the rates for. Chapter 7 bankruptcy can discharge the back taxes you owe to the IRS but you have to meet the following criteria.

Release Gottheimer Announces 357 Increase In Federal Tax Dollars Clawed Back From Washington To Jersey To Help Lower Property Taxes Make Life More Affordable U S Representative Josh Gottheimer

Federal State Local that are past due.

. Heres how the IRS defines income tax. The federal taxes approximated above are based on the 2022 marginal tax tables published by the IRS. Your bracket depends on your taxable income and filing status.

Taxes on income both earned salaries wages tips. Heres an example. If you fail to pay what you owe in taxes the IRS can.

10 12 22 24 32 35 and 37. There are seven federal tax brackets for the 2022 tax year. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional interpreters.

You were going to receive a 1500 federal tax refund. The income tax that one pays at the federal and state level is determined by applying a predetermined rate to the funds an individual or business has earned. Your back taxes need to be income tax debt and at.

Here are four common options that could help you find some tax relief plus guidance on how to file back taxes and how many years you can file back taxes for. Credit for backup withholding. Typically these are taxes that are owed from a previous year.

The income ranges the rates apply to are called tax brackets. Back Taxes or tax debt are unpaid taxes assessed against a taxpayer by a level of government ie. Internal Revenue Service IRS back.

Using the IRS Wheres My Refund tool. But you are delinquent on a student loan and have 1000 outstanding. If you had income tax withheld under the backup withholding rule report the federal income tax withholding shown on Form 1099 or W-2G on.

For single taxpayers and married individuals filing separately the standard. Viewing your IRS account information. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Help Filing Your Past Due Return. The 2022 standard deduction for married couples filing jointly is 25900 up 800 from the prior year. We perform a marginal tax calculation which does provide a good.

Prefill and prior year info saves you time then your etax accountant handles the. In the United States unpaid taxes can be owed at. Why you should file back taxes.

Do College Students Get All. The first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to. Back taxes are taxes that werent paid at the time they were due typically from a prior year.

The taxes that most people worry about though are federal income taxes. If you need wage and income information to help prepare a past due return. You can owe back taxes at the federal state or local level and you can owe them.

Tax debt is accumulated when an individual fails to pay the tax balance presented on their federal income tax return by the filing due date. Back taxes refer to an outstanding federal or state tax liability from a prior year. Federal income tax rates range from 10 to 37 and kick in at specific income thresholds.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. Back taxes is a term for taxes that were not completely paid when due.

Filing Back Taxes What To Know Credit Karma Tax

Tax Day 2015 Where Did Your Tax Dollars Go

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

Tax Lien Tax Champions Tax Negotiation Services

Irs Phone Scam You Owe Back Taxes

How The Government Can Collect Back Taxes New York State Tax Warrants Vs Federal Tax Liens Tenenbaum Law P C

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

What To Do If You Owe Back Taxes Bell Finance

Federal Vape Tax Reappears In Build Back Better New Cigarette Tax Vanishes

Back Taxes What Are They And How To Resolve Them With Irs Wiztax

Raleigh Nc Cpa Firm How To File Back Taxes Lauren Massie Cpa Pllc

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Tax Lien Relief Help With Release An Irs Of State Tax Lien

What To Do If You Owe The Irs Back Taxes H R Block

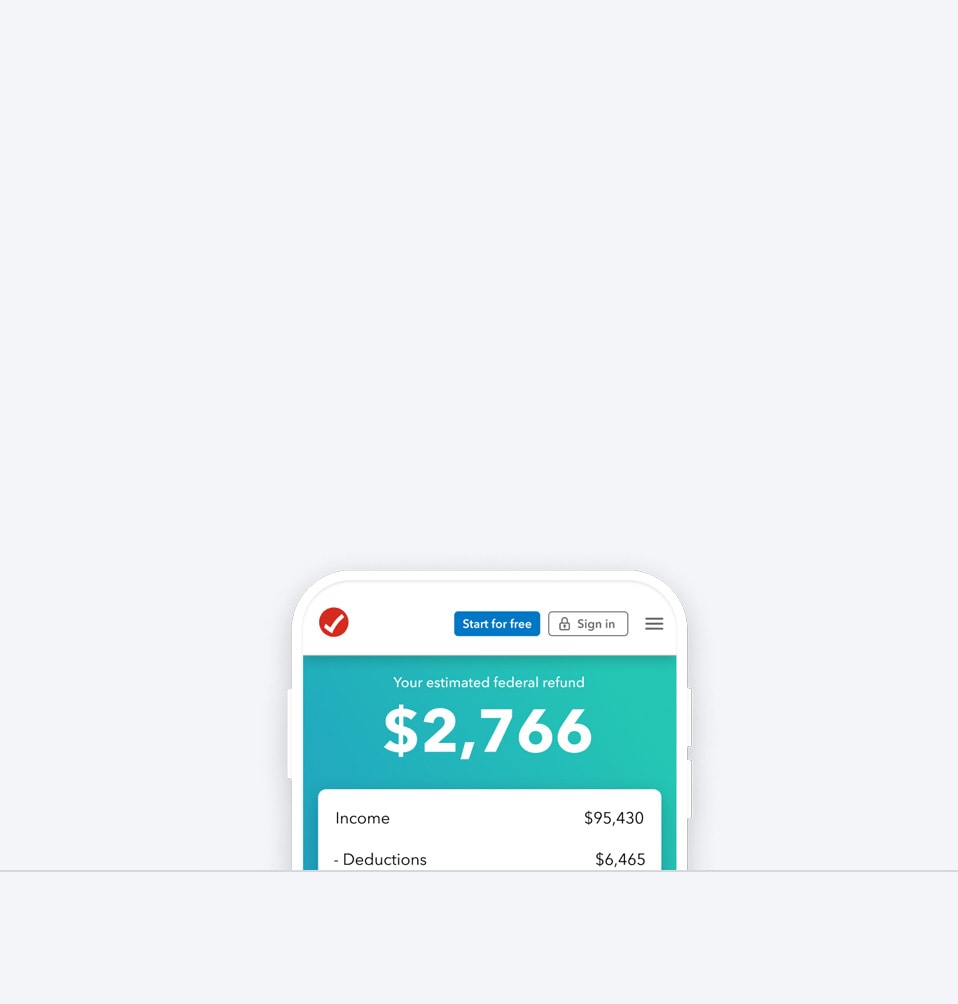

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official