fresh start initiative expires

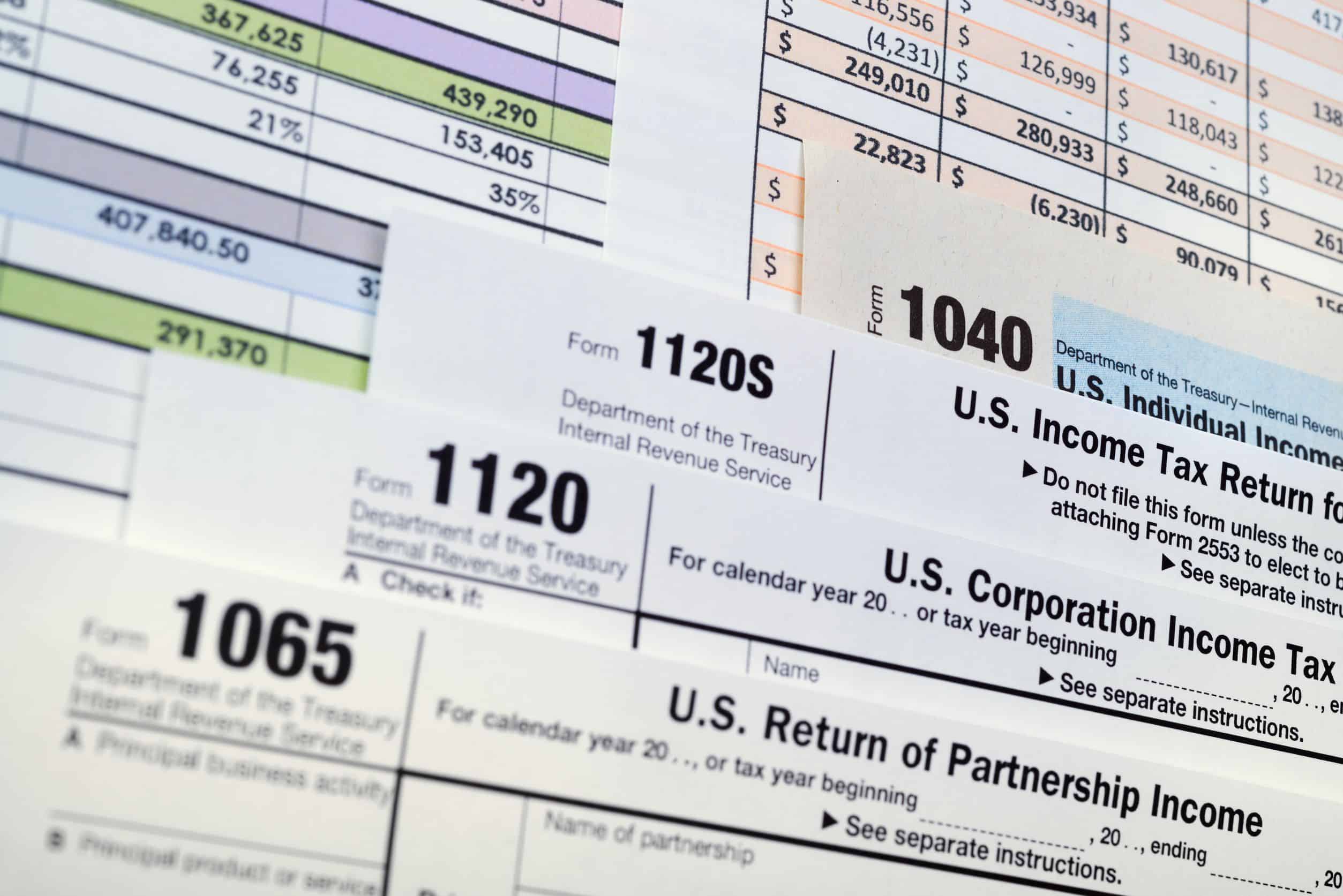

A tax lien will be filed with this type of agreement unless the debt is under 10000. What is the IRS Fresh Start program.

Visit The Scientific Laboratory Show And Conference 2022 Labmate Online

Before Fresh Start Initiative Expires.

. The program emphasizes facilitating. Others make it possible to pay off what you owe in. By giving the IRS these proofs a taxpayer proves not only facts but also trustworthiness which increases the chances of getting accepted to the Fresh Start program.

Launched at the Smithfield Show in December 2004 by Sir Don Curry the Fresh Start initiative aims to secure sustainable future for farming in England by. Propose to pay off your tax debt within the Collection Statute Expiration Date which basically means you will pay it off before the tax debt expires and the IRS will accept the payment plan. The primary provisions of the program included the following.

If you have received multiple notices from the IRS the agency may have placed a lien on your assets in its attempt to collect debts. Foreign-Derived Income and Assets. Generally payments are made until the IRS statute of limitations on collections expires.

Some magical bullet to simply give the IRS a fraction of the tax debt or pennies on the dollar and call it good. Expanded Penalty Relief Now expired IRS Fresh Start Tax Lien Changes. Learn more about the IRS Fresh Start Program here.

Before the Fresh Start Initiative the IRS issued tax liens for all kinds of liability levels. The Fresh Start Program is a collection of changes to the tax code. Instead its an initiative that changed numerous elements of the tax code.

What Changes Did the IRS Make with the FSI. Access to affordable quality food is critical to building strong neighborhoods. Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain crowd of people who owe the IRS money.

Generally the IRS has 10 years to collect the tax from the date of assessment. To show good faith and responsibility a taxpayer should keep financial records in an organized manner. The IRS began the Fresh Start program in 2011 to help struggling taxpayers.

Tax reduction programs under federal law provide real relief but they can be very complexed to navigate. Instead its an initiative that changed numerous elements of the tax code. The Food Retail Expansion to Support Health FRESH program brings healthy and affordable food options to communities by lowering the costs of owning leasing developing and renovating supermarket retail space.

However in some cases the IRS may still file a lien notice on amounts less than. Read and understand all terms prior to enrollment. The program is designed to help individuals and small businesses with overdue tax liabilities and it also has the benefit of helping the IRS by removing taxpayers from its vast collection inventory.

Since launching in 2009 28 projects have been approved for FRESH tax incentives. While its been titled a program the Fresh Start Initiative isnt really a program. GET A FREE TAX QUOTE.

As an online aggregator Fresh Start. The reason is that the Fresh Start Initiative changed IRS collection policy to lower the total number of months of income provided to the IRS from 48 to 12 months if the offered amount would be paid off in 5 months or less. IRS Fresh Start Program Simplifies Many Things For Taxpayers.

The Fresh Start Program also known as the Fresh Start Initiative was established by the US. If the offered amount is to be paid in 6 to 24 months the monthly disposable income is calculated over a twenty-four. Launched in 2011 the Fresh Start Initiative FSI was designed to give delinquent taxpayers a fresh start on their taxes owed.

The IRS Fresh Start Program is a catch-all phrase for the IRSs debt relief alternatives. The term Fresh Start Initiative is more fitting than Fresh Start Program since the Fresh Start Initiative isnt a new program that stands separately from existing tax laws. For the moderate eurosceptic pressure group founded in 2011 see Fresh Start Project.

The 72 month Fresh Start installment agreement must pay all tax periods within the statute. A program to forgive a persons tax debt. The new IRS Fresh Start initiative makes it easier for individual and business taxpayers to pay back taxes avoid IRS tax liens and get tax relief from the IRS.

The Fresh Start initiative makes it possible to pay smaller amounts over a longer period of time without getting penalized. In-business trust fund installment agreements are for debts of no more than 25000. Their platform is completely free to use and offers a no-risk consultation.

It offers varying levels of relief and repayment options based on the specific financial situation of each applicant. The IRS launched the Fresh Start initiative in 2011 for the purpose of helping more taxpayers to get back in good standing. Individual results may vary based on ability to save funds and completion of all program terms.

The FSI increased the tax debt threshold at. That amount is now 10000. The Fresh Start program can help you remove tax liens while.

5 years months or before the Collection Statute Expiration Date CSED expires whichever comes first. The Fresh Start Initiative was created in 2009 and was initially called the IRS Fresh Start Program. If youre experiencing or worried about liens levies garnishments or more now is the time to learn about your options to protect yourself and resolve your tax burden.

A program at all. The initiative is an extension of the IRS Restructuring and Reform Act of 1998. The objective of the program is to make it easier for tax delinquents to legally escape their monetary difficulties.

3 hours agoThe Fresh Start initiative didnt get much publicity because it was briefly mentioned in April when the administration announced that it was extending the loan pause for a sixth time. The IRS Fresh Start s a bit of a win-win --- the initiative makes it easier for individual and small. Taxpayers should note that the IRS.

It is for the IRS. The date at which the tax expires and is no longer legally collectible is. Over the years the initiative progressed with incremental changes to IRS collection procedures.

Instead Fresh Start Initiative or Fresh Start Program is a blanket term for a variety of changes the IRS made to their policies and. The service was established in 2014 and since then has served over 1 million visitors. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt.

Depending on your situation you could be eligible for one or more of these programs. The Fresh Start program is a channel for debt forgiveness not a one-size-fits-all option. Login About Us.

Youll need to explore the specific opportunities that may apply in your case. IRS Fresh Start Qualification Assistance. 4 5 Very good Fresh Start Initiatives goal is to help consumers restore control over all of their IRS tax debt issues.

Check If You Qualify For Free. Promoting an entrepreneurial culture amongst the next generation of farm business owners. In-Business Trust Fund installment agreements.

Program does not assume any debts nor provide legal or tax advice. The changes made as a part of the Fresh Start Initiative were designed to help. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien.

The changes contain different. That said anyone who owes a tax debt of 50000 or less to the IRS will almost certainly be qualified to initiate repayment under the Fresh Start initiative. The IRS Fresh Start Program isnt just for your benefit.

It is the federal governments reaction to the IRSs predatory methods which include the use of compound interest and financial penalties to penalize.

Consumer Insolvency Proceedings Comparative Legal Aspects A Guide To Consumer Insolvency Proceedings In Europe

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Bankruptcy Fresh Start Program The What And Why Day One Credit

Top 10 Ways To Reduce Your Food Waste At Home The Eco Experts

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

The Tax Help Guide Ultimate Resource For Tax Help Questions

Bankruptcy Fresh Start Program The What And Why Day One Credit

Program Helps People Get Fresh Start Fox 59

The Irs Tax Debt Forgiveness Program Explained

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit

R Ga London Launches Preservation Play An Initiative To Pay Back Nature Using Youtube Lbbonline

European Flag European Commission Strasbourg 8 6 2021 Com 2021 301 Final Report From The Commission To The European Parliament The Council And The Court Of Auditors Annual Management And Performance Report

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

If You Get This Email It Is A Scam Page 72 Tampa Racing

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit

What Is The Irs Fresh Start Program 72 Month Installment Agreement